Really RBD, I think about may be will. I would personally take action to, If i met with the utmost count on that the other resource was a beneficial slam dunk. My personal situation immediately is that I really don’t come across any sure one thing regarding the money globe……at the least any yes some thing generating a great protected return. New bull market in the Us holds is the next longest within the background. Possessions philosophy close me personally provides increased steeply within the last 3 years. Back at my prevent…..I state the simple money has been made……however, keep a glimpse out with the reduced holding good fresh fruit.

An alternative is actually a cash out refinance

Continue that HELOC discover. If you ask me, the fresh new steeped get wealthier because they gain access to funding whenever disaster try unfolding. I don’t blame him or her for this, heck 1 / 2 of united states in this area try rich compared to the the median You income. Rather I think in common certain dry powder on the crisis in the future. -Bryan

Bryan, You will be making some good affairs. Especially regarding dry powder. Let me consider I might create a no-brainer when there can be chaos. But when crappy stuff is occurring, it’s hard to see brand new solutions. I’d most likely stay glued to blue chip dividend backyard gardeners while i see him or her a knowledgeable. -RBD

75% for a financial loan age 5 yrs. We went certain amounts. If in case the loan number was $100K, complete appeal repayments over the 5 yrs towards HELOC try doing $7K. And what if we just take you to $100K and you will invest it at the a yearly go back from seven% for five yrs. That would started to $140K after 5 yrs, netting around $33K.

Now, the latest HELOC really does require you to create monthly installments away from $1786 four weeks, or $21429 a year. Imagine if you just encountered the discipline setting away so it money each year for five yrs at a substance yearly go back out of eight%? You’ll get $123K immediately following 5 yrs. That is only $10K less, than if you’ve received the fresh new HELOC.

One point not stated is when far property one has (away from domestic) and money to invest focus. I do believe men and women 2 issues are incredibly crucial.

Eg, once i basic ordered our lay, I concerned about make payment on mortgage as quickly as possible. seven years afterwards, the borrowed funds is a lot down, You will find significantly more assets i am also today choosing in which my personal currency is most effective once i convey more property. My set of skills on the technology world to own work is maybe not a problem sometimes and so i am perhaps not concerned about getting unemployed. This type of circumstances cary pounds in the using up obligations to service they besides doing the new math for the credit cost.

I just renewed my mortgage and even though I had six age leftover in it from the latest costs, I needed to blow way more as it tends to make more money than the interest so i reset the borrowed funds to twenty five years (maximum within the Canada) and that i have a speed of dos.65%. I can today purchase more than $step 1,500 a great deal more 30 days towards the top of what i currently save your self and you will invest.

In addition to, nothing states you will want to take out all your valuable collateral feel conventional and simply pull out some into the bucks, leaving equity of your house

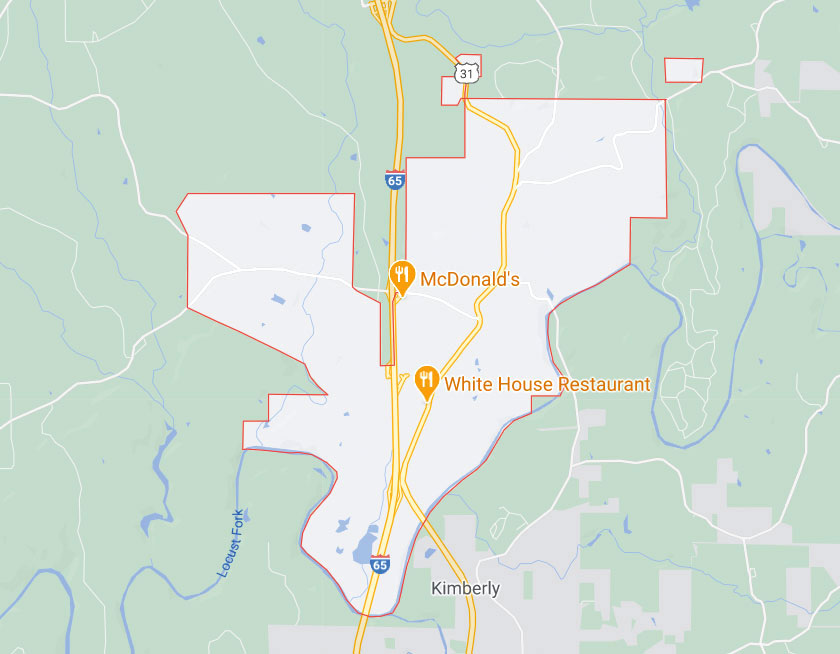

Earner, You make some good issues. I’m from inside the the same motorboat with a reliable occupation www.paydayloanalabama.com/cardiff/ than simply it absolutely was 5 years back. And my advantage feet is actually big now, and so i can handle the additional risk. We are not equivalent for the reason that I can not rating a two.65% home loan, which is outrageously lower. Great job on that. -RBD

You could potentially re-finance your current financial however, pull equity over to invest. You might be tied to a fixed rates with the mortgage, perhaps not changeable for example a good HELOC. In my opinion they absolutely is practical when planning on taking advantage of historically lowest financial prices.